Let’s be honest about this – if you’re selling your house then the question ‘Will my house sell?’ is pretty much the most important thing you can ask ( followed closely by ‘How much will it sell for?’ and ‘How quickly will it sell?’). We’re experts when it comes to the Scottish property market, but we’re not about to pretend we can give an exact answer to either of those questions.

What we can do – and what this article is all about – is take a look at the Scottish property market in general, detailing trends around aspects such as prices and the time it takes for the average property to sell. Over and above that, we’ll detail the steps you can take to make sure that your house has the very best chance of selling as quickly as possible, and how choosing the right estate agent is probably the most important step of all.

The State Of The Property Market In Scotland

The good news for anyone selling a house in Scotland just now is that the Scottish property market is particularly robust, especially when compared to the rest of the UK. Property website Rightmove published figures in March of this year which showed that Carluke in Lanarkshire, Scotland, was the quickest selling market in the UK, with the average time taken for a home to find a buyer being 24 days. What’s more, Falkirk was second with 26 days and Larbert third with 27 days. The average, across Scotland as a whole, was that it takes 43 days to find a buyer, something which contrasts with the 71 days taken across the UK as a whole.

A Resilient Market Place

The other piece of good news contained within the detail of the findings is that, while the UK housing market as a whole has cooled down during the course of the 12 months up to March 2024 – presumably in response to a period of higher interest rates and general economic slow-down – the impact was felt less in Scotland than anywhere else. In the UK as a whole, houses were taking two weeks longer to sell than at the same time a year ago, while in Scotland this figure had only increased by 3 days. In fact, in the following areas of Scotland, the time taken for a house to find a buyer has actually gone down over the course of the last 12 months:

- Carluke minus 10 days

- Falkirk minus 1 day

- Larbert minus 4 days

- Troon minus 4 days

- Port Glasgow minus 20 days

- Irvine minus 7 days

- Wishaw minus 11 days

- Denny minus 6 days

The same disparity between Scotland and the rest of the UK is highlighted in research published by Statista. These figures apply to the market as of January 2024, and state that the average number of days taken to sell a property in Scotland at that time was 42 days, contrasting with 75 days in the South east of England, 78 days in London and 80 days in Wales.

How Much Will My House Sell For?

These figures are useful for giving an ‘across the board’ impression of what’s happening in the Scottish residential property market. The Registers of Scotland website published figures in May 2024 which took a deeper dive into the housing market in Scotland, looking in particular at the prices fetched by properties in Scotland, broken down by location and property type.

For the sake of this particular article, we can ignore the findings relating to new build properties, and concentrate, instead, on what the research found about existing dwellings. The figures in question relate to 2023 as a whole, compared to the previous 5 years, and found that while the volume of sales in 2023 had been the second lowest over that longer period (only 2020 was lower, during the first 12 months of the pandemic) the median residential property price over that period had risen by 1%, to hit £185,000. Higher median prices were recorded in 21 out of the 32 local authorities across Scotland, and over the five year period in question, median property prices in Scotland had risen by 19.4%, from £155,000 in 2019 to £185,000 in 2023.

For some sellers, the most useful part of the data published by Registers of Scotland will be the comparison between urban and rural residential property sales. The number of property sales in the different regions broke down in the following way:

- Accessible Rural 13,932 sales in 2023

- Remote Rural 4,993 sales in 2023

- Rest of Scotland 74,884 sales in 2023

The price rises across the different markets in Scotland were 40% in accessible rural areas, 30% in remote rural areas and 13% in the rest of Scotland.

2024 Property Sales

A report published by real estate experts Savills in April 2024 looked mainly at the prime property market, which means houses which change hands with a net agreed sale price in excess of £500,000. The number of sales in this sector of the market during the first three months of 2024 was up by 16% year on year, while those below £500,000 increased by 9%, with the feeling being that the boost to the sub £500,000 market was delivered mainly by the improvement in borrowing rates seen since the summer of 2023.

Rising Sales Numbers

Further evidence of the overall resilience of the residential property market in Scotland came with figures published in Insider.co.uk, relating to research carried out by the Royal Institution of Chartered Surveyors (RICS). These figures related initially to January 2024 and found that 17% of respondents reported that newly agreed sales rose at the beginning of 2024, the first time this particular metric had been positive since June 2023, and the highest level in three years.

The demand from new buyers also rose in January, with an increase of 27% pushing the level of demand to its highest point since July 2021. The data didn’t only pick up on a positive start to the year, however, it found that 62% of respondents expected the number of sales to keep on rising over the course of the next 12 months, a figure which was the highest it had been since early 2021. At the same time, 46% of respondents stated that they expected prices to rise over the next 12 months.

Rising Prices

The positive outlook on prices was underlined by a report in Property Reporter, which stated that the average house price in Scotland had risen by 4.8% during the 12 months between January 2023 and January 2024, to reach £190,328. This was in stark contrast to the situation in the rest of the UK, which had seen a drop in prices over the same period of 0.7%. Indeed, only two other regions had been able to boast an increase in house prices, and these were the North West of England at 1% and the West Midlands at 0.6%.

Although the figure for Scotland as a whole is impressive, the breakdown of average prices per Unitary Authority district demonstrates that in some parts of Scotland the growth in house price has been even more spectacular. In The Outer Hebrides, for example, prices have risen by a staggering 15.2% on average. The other Scottish districts which have seen a rise in house prices of more than 5% year on year are as follows:

- Midlothian – plus 8.3%

- East Lothian – plus 8.1%

- East Dunbartonshire – plus 6.1%

- East Renfrewshire – plus 6.1%

- Renfrewshire – plus 6%

- City of Edinburgh – plus 5.4%

- City of Dundee – plus 5.3%

- City of Aberdeen – plus 5.2%

How The Scottish System Helps

It would be easy to spend quite a long time theorising about why the residential property market across Scotland manages to outperform the equivalent in the rest of the UK – waxing lyrical about the quality of life and the warm welcome we like to give to newcomers, for example – but the explanation is likely to be relatively simple.

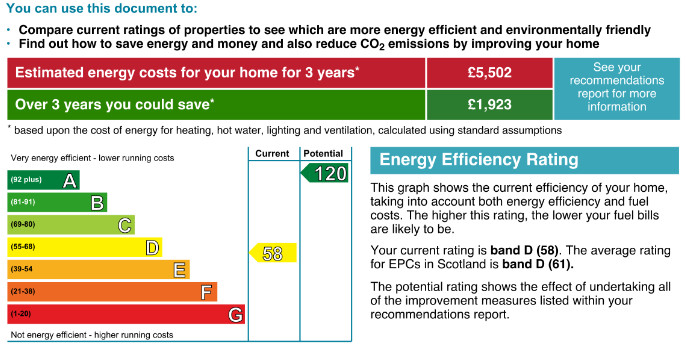

The process of selling your home in Scotland is doubtless speeded up by the conveyancing process, which means that sellers generally provide a Home Report, Energy Performance Certificate and a property questionnaire, making it simpler for prospective buyers to make up their minds. In most cases, the seller will also provide a survey which can be used by the buyer to obtain mortgage approval.

As long as the firm carrying out the survey is on the approved panel referred to by the lenders there are generally no obstacles in the way of mortgage approval being granted. Not only does this expedite the sales process, it also greatly reduces the number of reduced valuations arrived at during the conveyancing process, something which is a much more common feature of conveyancing across the rest of the UK, and which often leads to the sellers pulling out of the sale or having to take the time to renegotiate.

In addition to the thoroughness of the conveyancing process, the housing market in Scotland is streamlined when it comes to selling times by the fact that the agreement between buyer and seller becomes legally binding at a far earlier stage than is the case in the rest of the UK. In simple terms, once an offer has been received and resulted in a ‘qualified acceptance’ dependent on certain conditions, all that remains is for your solicitor to send a letter to the buyer’s solicitor setting out those conditions. The buyer’s solicitor and your solicitor may then negotiate on the precise conditions, exchanging letters known as ‘missives’. Once the missives have been accepted and the terms agreed on, the sale becomes legally binding, with the buyer and/or seller liable to face legal or financial consequences if they pull out.

A Few Small Details

So far, so positive if you’re keen to sell your house in Scotland, but there are a few (not quite so) small details which still need to be taken into account. No matter how resilient or even vibrant the wider housing market is, your sale will take longer than it need do – or maybe not even happen at all – if you make a mistake when choosing your estate agent.

We’ve written at length on the topic of how to choose the right estate agent, with particular emphasis on making sure you’re working with an estate agent likely to arrive at a realistic valuation for your house. In simpler terms, this means looking for an estate agent with a proven track record of not only successful transactions across the board, but also sales involving houses which are similar to yours.

An estate agent used to selling properties like your home will probably have an existing list of potential buyers to call upon, something which could provide a dramatic short-cut to a final sale. In addition to this kind of specialist knowledge, you’ll be looking for an estate agent with a combination of marketing skills and a highly proactive approach to any enquiries made.

Local Knowledge

When it comes to the property valuation, the estate agent you choose should be able to combine an inspection of the property itself with their in-depth knowledge of the market conditions, with particular regard paid to local factors. Your estate agent should be fully conversant with up-to-date details of local factors such as transport links, schools and any planned developments, and they should be able to explain exactly how these factors have impacted the value and selling price of houses similar to yours.

The key to finding an estate agent able to offer all of this and more is to never be afraid of asking questions and forcing them to sell themselves with the same thoroughness you hope they’ll bring to selling your house. If you call into our office in Alloa, you’ll find a friendly team who are happy to answer any questions you might have, and explain exactly how we’d set about selling your home.

Over To You

Having chosen the right estate agent and been given a realistic, market-centred valuation, the only thing left for you to do to expedite the sale of your house is to make sure it looks as appealing as possible.

You won’t be surprised to learn that we’ve written our own guide on how to do this, and the summary is that it covers everything from tidying the garden and cleaning exterior paving stones to drawing up a snag list of those little jobs (fixing cracked plug sockets, for example) that you’ve been putting off doing as well as de-cluttering the interior of the space. Did we mention the deep clean, furniture arranging and lighting? It can sound like a lot of work but trust us, for the sake of a speedy sale at or even above the asking price, it’s work that’s well worth doing. And if the worst comes to the worst, and your house doesn’t sell quickly (sometimes external events like a financial slump or misguided budget can scupper even the best laid plans), the experts at O’Malley Property will be on hand to explain how to deal with the situation, particularly if the need to move is urgent.